The Future of AI Market Intelligence in 2025: From Static Reports to Real-Time Insights

For decades, market intelligence in industrial and B2B sectors was a periodic exercise. Analysts compiled quarterly reports, commissioned surveys, and produced dense research decks. The material was often detailed, but by the time it reached executives, the landscape had already begun to change. For years, that lag was tolerated because decisions moved at a slower cadence. In 2025, that cushion is gone, and the old rhythm no longer works.

Regulatory shocks can open or close entire markets almost overnight, from new tariffs that reshape trade flows to subsidies that accelerate adoption curves. Commercial signals move just as quickly: offtake agreements validate demand in days, joint ventures reconfigure supplier networks, and pilot projects mark the first signs of traction. Competitors amplify this volatility by announcing partnerships or product launches that shift customer expectations in real time.

Artificial intelligence is changing this equation by shifting intelligence from static reporting to continuous foresight. As Fei-Fei Li, co-director of Stanford’s Human-Centered AI Institute, has noted, “The future of intelligence is not artificial or human alone, but a collaboration between both.” The organizations that thrive are embedding AI not as a bolt-on tool but as the connective tissue of their research and decision-making workflows. To see the broader context, explore How AI is Transforming Market Intelligence in 2025.

Why 2025 Is the Tipping Point for AI Market Intelligence

The pressure to rethink market intelligence stems from three converging forces.

-

Policy Shifts and Subsidies Reshaping Industrial Markets:

Carbon tariffs, subsidy programs, and shifting standards no longer evolve over years—they can reshape competitive positions in months. A single government announcement can either ignite or stall billion-dollar markets.

-

Commercial Signals: Offtake Agreements, Pilots, and Joint Ventures:

From hydrogen electrolyzers to sustainable aviation fuel, capital deployment has accelerated. Monitoring offtakes, EPC contracts, and pilots now requires continuous tracking.

-

Supply Chain Volatility and the Need for AI Monitoring:

Weather disruptions, geopolitical tensions, and logistics constraints can cascade through industries in days. Early detection is no longer optional; it is a competitive necessity.

Satya Nadella put it simply at Davos this year: “In a world where every industry is becoming data-driven, the companies that turn signals into decisions fastest will define the next decade.”

How AI Transforms Industrial Market Research and B2B Strategy

The most important transformation is not technological but organizational. Research is moving from static, siloed reporting to dynamic, shared intelligence streams.

-

Continuous Intelligence Feeds Validated by Analysts:

Instead of waiting for quarterly earnings, AI tracks permits, filings, and pilots as they happen, while analysts provide judgment and context.

-

Shared Market Dashboards Across Business Functions:

Strategy, commercialization, and product teams now draw on the same stream of signals, improving alignment and compressing cycle times.

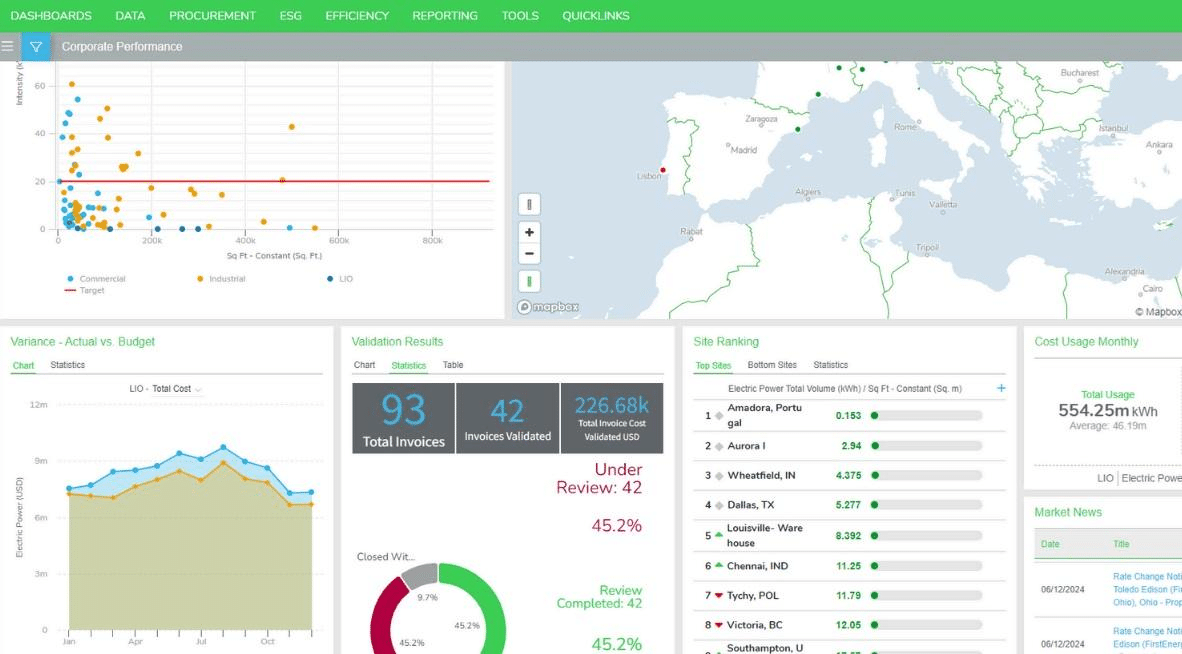

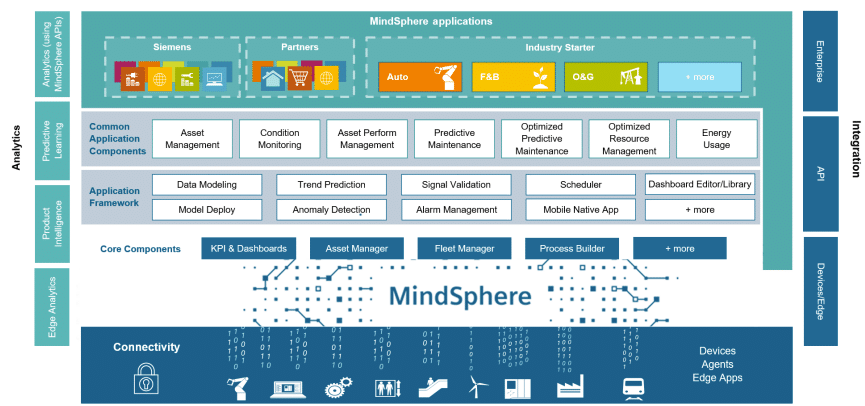

Siemens Energy demonstrates this shift with its MindSphere platform. Initially designed for predictive maintenance, it now feeds intelligence across service demand, supply chain stability, and product strategy. Schneider Electric has embedded AI in its EcoStruxure system, turning sustainability reporting into real-time ESG insights that inform both compliance and strategic planning.

Figure 1: Schneider Electric’s ESG Reporting Tool

Jensen Huang, CEO of NVIDIA, describes it this way: “Every company is becoming an intelligence company.” Market intelligence is no longer an isolated function—it is the operating system of the enterprise.

For executives exploring workflow design, market research with LLMs such as ChatGPT and Perplexity shows how natural language models now underpin industrial-scale research pipelines.

Where AI Creates Value in Market Intelligence

The value of AI-driven market intelligence is visible in practice.

Predictive maintenance illustrates the point. Siemens uses AI models to anticipate component failures in turbines and pumps, cutting downtime by up to 50 percent and lowering maintenance costs. But the same data also predicts aftermarket demand for spare parts, enabling a steady, high-margin revenue stream. What was once a maintenance function has become a forward-looking market signal.

Figure 2: Siemens MindSphere Architecture

Commercial foresight is just as critical in procurement. Resilinc, an AI-powered platform, combines shipping data, geopolitical developments, and satellite imagery to flag vulnerabilities. One global electronics firm rerouted rare earth shipments weeks ahead of competitors after AI detected weather disruptions in Asia. The move safeguarded production while rivals scrambled for replacements.

Regulatory monitoring has shifted from reactive to proactive. Northern Light enables companies to track and analyze policy changes across jurisdictions. A North American automaker used it to adapt its EV sourcing strategy months before CBAM tariffs were formalized, avoiding penalties and securing a stronger supplier base.

Finally, white-space identification has become a differentiator. Draup synthesizes trade flows and investment data to uncover underserved niches. A European conglomerate leveraged these insights to move early into EV charging infrastructure in Eastern Europe, capturing share in a market competitors had overlooked.

These examples echo what Vinod Khosla has argued: “AI is not just changing how we work, but redefining what opportunities are even visible to us.” For practical comparisons, see the best AI market intelligence tools in 2025 or explore AI-powered insights that connect data to strategy.

Table 1: Traditional Market Research vs AI-Driven Market Intelligence

| Approach | Cadence | Typical Output | Strategic Risk |

|---|---|---|---|

| Traditional Broker Research | Quarterly or semiannual | 80-page reports, decks | Insights lag reality; decisions miss inflection points |

| AI-Augmented Intelligence | Continuous, event-driven | Dashboards, alerts, scenario models | Signals aligned in real time; earlier pivots possible |

Executive Takeaways: Building Continuous AI-Driven Market Intelligence

The future of AI market intelligence is defined by cadence and visibility. Predictive maintenance signals forecast aftermarket demand. Commercial agreements like offtakes and joint ventures validate growth trajectories. Policy monitoring ensures companies adjust before regulations take effect. Automated market sizing highlights untapped niches. What once took quarters now unfolds as real-time strategic intelligence.

For executives, the implications are profound. Boardrooms shorten the cycle from question to answer. Product teams launch with greater confidence. Strategy functions detect inflection points before rivals.

Those embedding competitive intelligence with AI are tracking new entrants in real time. Others applying AI for ESG and policy research are reducing risk while improving positioning. Early adopters of AI trend analysis and AI demand forecasting and cost models are already reallocating resources to more resilient bets.

The lesson is clear: companies that embed AI into their market intelligence workflows are not simply keeping pace—they are shaping markets. As Fei-Fei Li emphasizes, the strongest enterprises will be those where human expertise and AI work in tandem. And as Jensen Huang reminds us, intelligence itself is becoming the new infrastructure of business.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.