How AI Is Transforming Market Intelligence in 2025

Artificial intelligence has already changed how companies handle customer engagement, marketing, and sales. The bigger story in 2025 is its role in reshaping market intelligence for industrial and B2B sectors. This field has long depended on scattered signals buried in filings, regulatory dockets, announcements, technical documents, and patent fillings. Analysts would spend weeks assembling insights, often arriving too late to shape real decisions.

AI is altering that rhythm. By compressing the time it takes to reach conclusions, widening the aperture of sources, and enabling forward-looking scenarios, it turns intelligence into a continuous capability rather than a quarterly exercise. Importantly, this shift does not displace expert judgment; it amplifies it. As Erik Brynjolfsson has argued, “the real promise of AI is not replacing humans but augmenting them.” The firms moving fastest are those treating AI as an extension of their analyst teams and embedding it across product development, strategy, commercialization and policy.

Enki, positioned as a system of record for industrial signals, illustrates this transformation by stitching together patents, policies, offtakes, pilots, and supplier data into one workflow with citations and analyst review.

Why AI Is Changing B2B Market Research in 2025

In the last few years, consumer-facing applications absorbed most of the attention. Chatbots, summary generation, and sales enablement showed how large language models could handle repetitive text tasks at scale.

Industrial markets present a different challenge. The signals that matter—early-stage pilots, regulatory actions, supplier announcements, and scattered commercial disclosures—are dispersed across formats, buried in PDFs, translated from multiple languages, and reported on irregular cycles. Pulling these fragments together into a coherent view has long required weeks of manual work.

That difficulty might have been acceptable when decisions moved slowly. But across industrial sectors, the cadence has accelerated. Competitive entry is faster, supply chains are more fragile, and product lifecycles are shaped by shifting policy and technology costs. The energy transition illustrates this dynamic most clearly: billions in capital are being deployed, carbon pricing and regulation alter margins almost overnight, and product and commercialization teams must decide when to launch offerings and how to position them before rivals do. Ajay Agrawal explains this shift simply: “AI reduces the cost of prediction.” For industrial companies, this means anticipating where the market is going sooner and with more confidence, enabling better capital allocation and strategic timing.

Table 1: Key Industrial Data Sources for Market Intelligence

| Source Type | What It Reveals | Example Signal | Typical Cadence |

|---|---|---|---|

| Patents & Filings | R&D direction, emerging competitors | Hydrogen electrolyzer patent from Siemens Energy | Quarterly |

| Regulations & Policy | Market access, compliance cost shifts | EU CBAM guidance | Monthly |

| Offtakes & PPAs | Demand validation, price discovery | SAF offtake with airline | Event-driven |

| EPC Awards & Permits | Asset deployment, supply chain exposure | Hydrogen EPC contract | Weekly |

| Earnings Transcripts | Strategic priorities, cost signals | Capex disclosure by OEM | Quarterly |

| Pilots, Partnerships & JVs | Early traction, ecosystem building, go-to-market strategy | Joint hydrogen pilot with Toyota, Coca-Cola and Air Liquide | Event-driven |

As organizations embrace the future of AI market intelligence, they are recognizing that the combination of AI retrieval, multilingual coverage, and analyst review is no longer optional—it is becoming a baseline requirement.

How AI Transforms Market Intelligence Operating Models

Market research has historically been episodic. Teams combine expert interviews, structured datasets, survey panels, broker research, and public filings to produce comprehensive reports on quarterly or semiannual cycles. The method delivers depth, yet the cycle time often lags the market; by publication, policy rulings, offtakes, or supplier capacity may already have shifted.

AI transforms this model into something more fluid:

- Continuous feeds validated by humans, rather than scattered contacts.

- Systematic monitoring across commercial signals, instead of reliance on selective news articles.

- Rolling scenarios with explicit assumptions, replacing static, one-off reports.

- Shared intelligence streams for product, commercialization, and strategy, not a siloed research team.

The role of the research team shifts to stewarding watchlists and alerts, which each function can tap directly. At Vale, the corporate strategy team has used AI to rapidly distill competitor insights from earnings calls and broker research, producing board-ready briefings in days rather than weeks. Dow’s business development group made a similar shift—replacing fragmented reports and escalating broker costs with a single flow of auto-alerts and dashboards that now serve commercialization, strategy, and finance simultaneously. Economist Erik Brynjolfsson describes this shift as “moving from one-off insights to continuous augmentation.”

For more on how teams design these workflows, see market research with LLMs: ChatGPT, Perplexity and beyond.

Where AI Creates Value in Market Intelligence Today

The conversation around AI often drifts into hype. But in industrial intelligence, value is already being created in four clear ways:

Supporting Existing Market Research with AI: Competitive scans, landscape refreshes, and earnings summaries delivered in hours rather than weeks. Vale’s strategy team exemplified this by compiling a comprehensive competitor analysis for its board using AI-driven synthesis.

Filling Gaps in Early Markets Using AI Signals: Signals from pilots, grants, and patents combined into composite traction scores.

AI Forecasting Demand in 2025 Industrial Markets: Policy triggers, tenders, imports, and hiring patterns used as proxies for near-term demand.

Creating New Insight Types with AI in Market Intelligence: Supply chain digital twins, scenario models for cost parity, and supply risk forecasts.

Andrew Ng often reminds executives that “AI is the new electricity.” Just as electrification once transformed every industry, AI now powers new kinds of industrial foresight that were previously impossible. Schneider Electric demonstrates this with AI-embedded EcoStruxure, enabling one oil and gas operator to cut energy consumption by a third while boosting production by 13 percent.

For comparisons of tools, see best AI market intelligence tools 2025. To explore methodology, review AI powered market insights: from data to strategy.

B2B AI Use Cases That Deliver Results in 2025

Some use cases are no longer experiments; they have become part of the analyst toolkit.

AI Patent and R&D Synthesis for Faster Insights: AI distills lineage, shifts in assignees, and key claims into a concise two-page brief.

Automated Competitive Landscape Mapping with AI: Entrants in hydrogen, CCUS, or batteries mapped by geography and partnerships.

AI Trend Analysis for Emerging Technologies: The cadence of grants, pilots, and offtakes tracked as early traction signals.

AI Cost-Trajectory Models and Scaffolds: First-pass ranges for electrolyzers, SAF, or SMRs modeled with learning rate assumptions.

At a Fortune 500 chemical company, a market intelligence analyst used Enki.AI to review thousands of patents, cluster them by technology theme, and identify white-space opportunities. Work that once took two full days was completed in two hours. Brynjolfsson’s insight is apt here: “AI doesn’t replace judgment; it makes it more productive.”

AI Competitive Analysis: Tracking Market Shifts Faster

Competitive intelligence has always been critical, but it was too often a snapshot: a slide deck produced quarterly. AI enables something more dynamic.

- Aggregated feeds from press releases, procurement notices, and local media.

- Early detection of new entrants through hiring spikes, domain registrations, and permits.

- Network mapping of partnerships and supplier constellations that reveal strategic intent.

- Policy intelligence showing how CBAM phases or IRA guidance reshape margins.

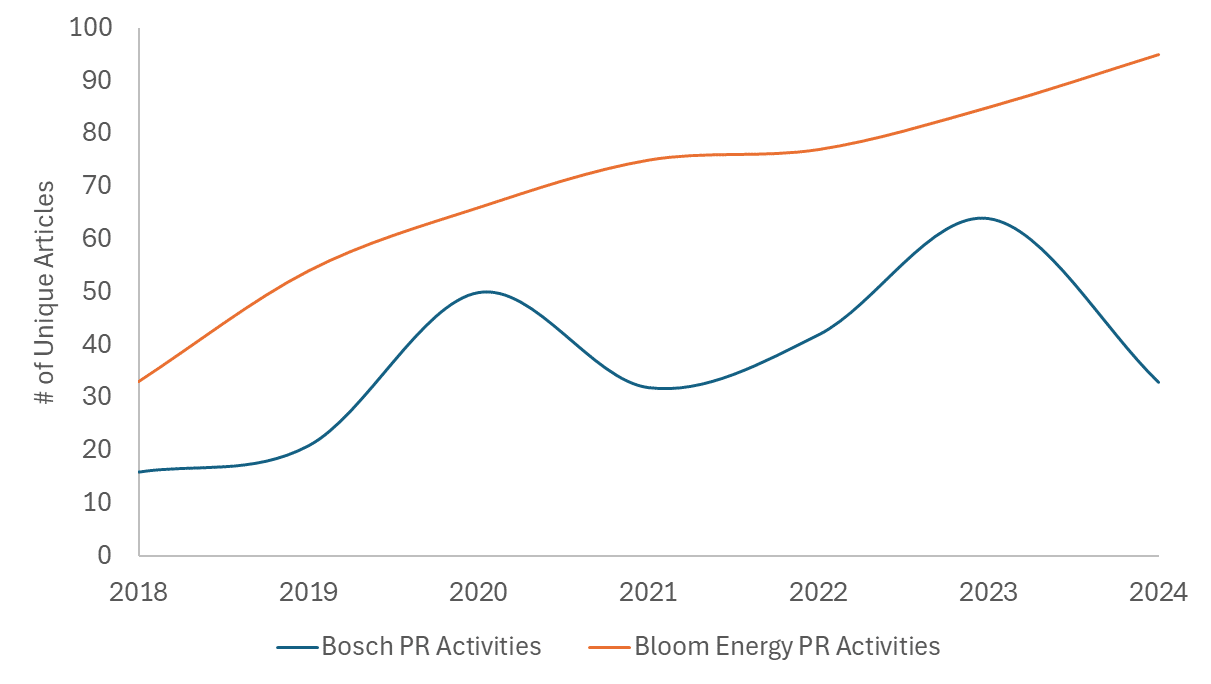

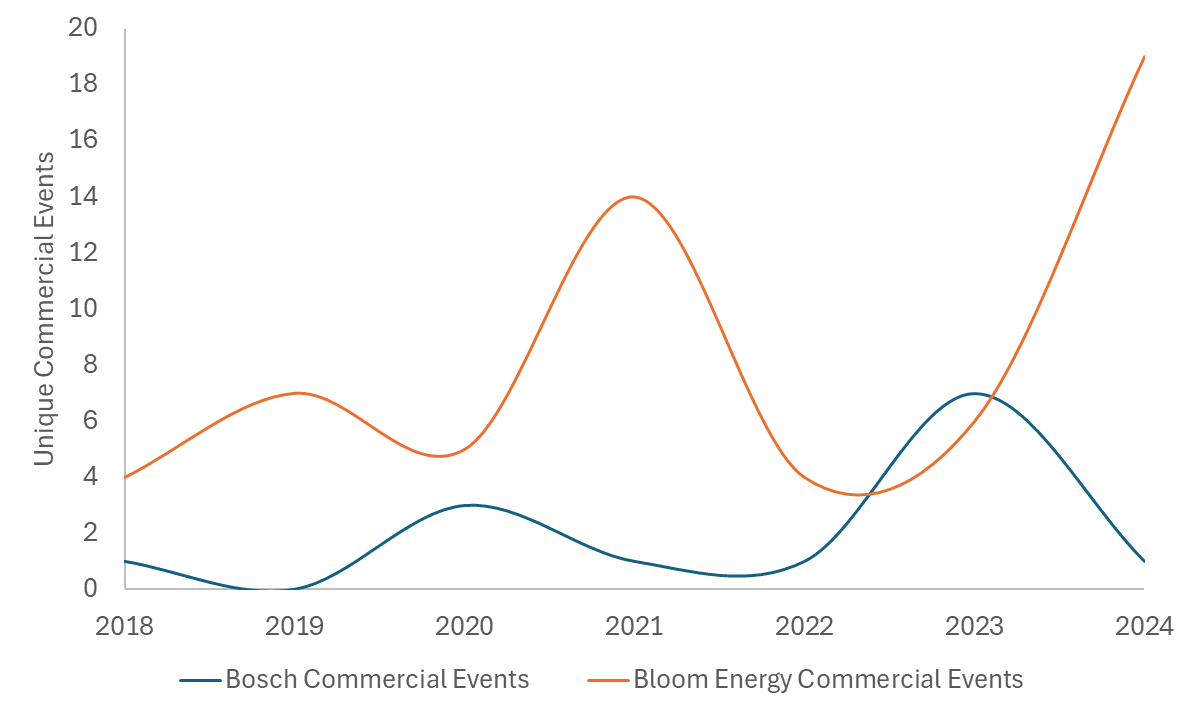

One of Enki.AI’s customers in the solid oxide fuel cell supply chain wanted to identify the right partners among market leaders. Their shortlist included Bloom Energy and Bosch, and early traction suggested Bosch might be the better bet. By tracking commercial signals—partnerships, joint ventures, pilots, and project installations—Enki.AI surfaced a different story: Bosch’s activity had stagnated, while Bloom’s momentum was accelerating. Enki.AI flagged Bosch’s eventual exit six months before it became public and highlighted Bloom’s rise almost a year in advance of market consensus.

The evidence was clear in the signals: Bosch’s PR activity flattened and declined, while Bloom’s announcements continued climbing. Sentiment analysis told the same story—Bosch’s coverage trended downward even as Bloom’s credibility strengthened. These forward signals helped the customer pivot toward Bloom as the stronger long-term partner.

Figure 1: PR Mentions and Market Signal Amplification.

This figure compares total PR signals—including company press releases and external market amplification (e.g., media coverage, analyst mentions, third-party narratives) in solid oxide fuel cells.

Figure 2: Commercial Events Timeline – Bloom vs Bosch (2018–2024).

This chart tracks the unique commercial events for Bloom Energy and Bosch in the solid oxide fuel cell (SOFC) market. It includes deployments, pilots, JVs, partnerships, and installations.

Agrawal’s framing applies perfectly here: “AI lowers the cost of prediction.” That predictive advantage allowed the customer to pivot toward Bloom as the stronger long-term partner. Enki converts these kinds of feeds into weekly CI digests, monthly landscape updates, and exportable partner maps that business development and strategy teams can use directly in decision-making. For more, see competitive intelligence with AI.

From Signals to Strategy: Turning AI Insights Into Action

Signals by themselves are noise. The power comes in aligning them into strategy choices.

- Patents, venture deals, and M&A show where entrants are positioning.

- Offtakes, PPAs, and pilots validate demand readiness.

- Policy rulings and standards dictate timing and compliance.

- Earnings calls and capex disclosures reveal incumbent moves.

When two or more signal types align, it is time to treat the shift as material and adjust plans.

Table 2: From Market Signals to Strategic Action

| Signal Type | What It Predicts | Example Watchlist | Next Action |

|---|---|---|---|

| Venture Funding | Likely entrant capacity | SAF startups with >$50m | Track offtakes, add to CI |

| Offtake/PPA | Demand validation | Hydrogen PPAs in Germany | Map supplier exposure |

| Policy Ruling | Cost shift, access | IRA guidance on 45V | Update cost parity model |

| Permits & FIDs | Real deployment | Nuclear SMRs in Canada | Adjust capacity forecasts |

| Earnings Calls | Strategy pivots | OEM capex disclosures | Revise competitive map |

Enki automates these watchlists, highlights state changes, and distributes scenarios with transparent assumptions. See AI powered market insights: from data to strategy for methodology.

AI Market Intelligence: Limitations and Best Practices

No technology is without risks. Overreliance on AI can produce false precision if not governed carefully.

- Sparse data in niche markets requires careful validation. The challenge is not only scarcity but also reliability. Early signals are often incomplete, biased, or contradictory. Multilingual sourcing widens coverage, but validation is essential to separate noise from genuine insight.

- Announcements often lag real deployment. Press releases can generate headlines long before anything material happens. Permits, purchase orders, and in some cases satellite imagery provide stronger evidence of progress and should carry more weight in forecasting.

- Vendor-produced cost curves can contain bias. Forecasts may reflect optimistic assumptions that favor a particular company or technology. Independent assumptions, sensitivity ranges, and transparent scenario modeling are necessary to avoid false confidence.

- Security is paramount. Market intelligence is most credible when external signals are cross-checked with internal knowledge. Commercial know-how, feedback from the sales force, and operational chatter provide context that prevents blind spots and grounds external insights in organizational reality.

Enki’s approach addresses these risks directly:

- Credible sources first: trusted corpora such as the U.S. Department of Energy (DOE), Energy Information Administration (EIA), European Commission filings, IPCC reports, patents, permits, and regulatory dockets.

- Citation-first outputs: every insight includes its source and timestamp for transparency.

- AI quality agent validation: every high-impact insight is screened through automated checks before release, ensuring accuracy and consistency without human intervention.

Thought leaders reinforce the point. Brynjolfsson emphasizes augmentation, Agrawal focuses on prediction economics, and Ng insists that “the integrity of data remains the foundation of decision-making.”

Conclusion: The Future of AI in B2B Market Intelligence

The true impact of AI is not measured in novelty but in cadence. It gives industrial B2B teams the ability to act on signals as they emerge, rather than react months later.

- Boardrooms gain faster cycles from question to answer.

- Operational teams encounter fewer surprises and earlier warnings.

- Strategies become more resilient, anchored in traceable assumptions.

As Brynjolfsson reminds us, “AI will not replace managers, but managers who use AI will replace those who do not.” Early adopters are already compounding advantage by moving from static reports to continuous foresight. The organizations that embrace this shift are positioning themselves not just to understand the market, but to shape it.

To see how this plays out in practice, explore AI for ESG, policy, and energy market research, where the integration of signals becomes the engine of strategy.

Fresh. Personalized.

Instant.

Enki continuously scans clean-tech filings, press, and niche sources to surface projects, deals, and signals others miss.

See all the commercial insights, 50+ signals such as partnerships, offtake agreements, power purchase agreements, MoUs, ..

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.